1st, Feb, 2025

Top Cement Companies Q3 Performance Report (FY 2024-25)

The third quarter of the financial year 2024-25 has brought a mixed performance for India’s leading cement manufacturers. While some companies showed strong growth in revenue and profit, others faced significant declines. Let’s take a closer look at the financial results of the top cement brands for Q3, ending on December 31, 2024.

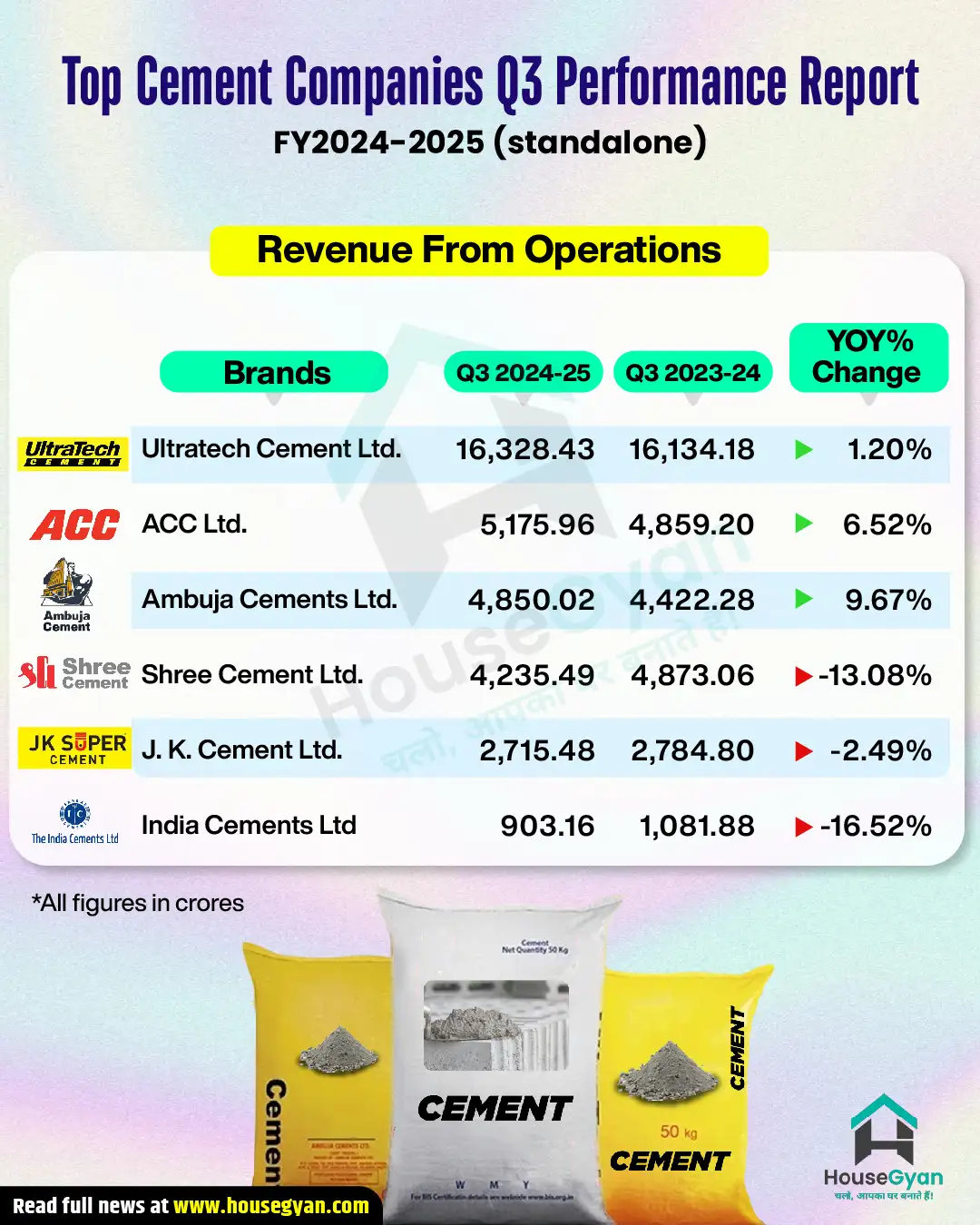

Revenue Comparison: Q3 FY 2024-25 vs Q3 FY 2023-24

UltraTech Cement Ltd.

The company reported a marginal revenue growth of 1.20%, increasing from ₹16,134.18 crore in Q3 FY 2023-24 to ₹16,328.43 crore in Q3 FY 2024-25. Despite the slight increase, higher operational costs impacted overall profitability.

ACC Ltd.

ACC demonstrated strong revenue growth of 6.52%, with revenue rising from ₹4,859.20 crore in Q3 FY 2023-24 to ₹5,175.96 crore in Q3 FY 2024-25. The company's focus on operational efficiency and cost management contributed to this positive performance.

Ambuja Cements Ltd.

Ambuja Cements recorded a 9.67% increase in revenue, growing from ₹4,422.28 crore to ₹4,850.02 crore. This growth highlights its strong market position and efficient production processes.

Shree Cement Ltd.

Unlike its competitors, Shree Cement witnessed a revenue decline of 13.08%, dropping from ₹4,873.06 crore to ₹4,235.49 crore. Slower demand and higher input costs contributed to this decline.

J.K. Cement Ltd.

J.K. Cement reported a slight dip of 2.49% in revenue, decreasing from ₹2,784.80 crore in Q3 FY 2023-24 to ₹2,715.48 crore in Q3 FY 2024-25. Market conditions and rising expenses played a role in this drop.

India Cements Ltd.

The company faced a significant revenue decline of 16.52%, with revenue falling from ₹1,081.88 crore to ₹903.16 crore. Challenges in demand and pricing pressures affected its performance.

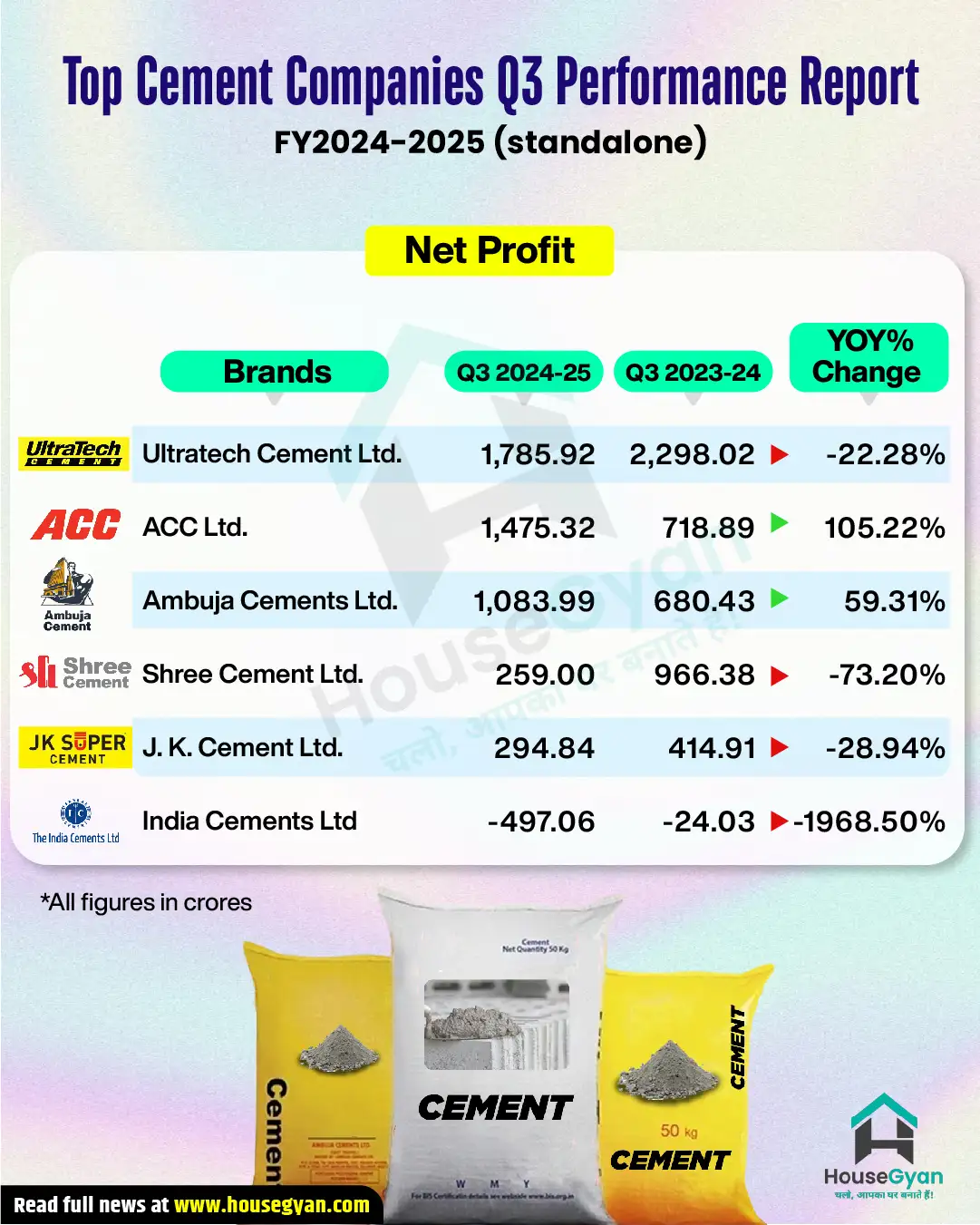

Net Profit Analysis: Q3 FY 2024-25 vs Q3 FY 2023-24

UltraTech Cement Ltd.

Despite revenue growth, UltraTech Cement’s net profit declined by 22.28%, from ₹2,298.02 crore to ₹1,785.92 crore. Increased fuel and operational costs put pressure on margins.

ACC Ltd.

ACC delivered a remarkable 105.22% growth in net profit, jumping from ₹718.89 crore to ₹1,475.32 crore. The company’s focus on cost efficiency and better pricing strategies contributed to this sharp increase.

Ambuja Cements Ltd.

Ambuja Cements also showed strong profitability, with net profit rising 59.31%, from ₹680.43 crore in Q3 FY 2023-24 to ₹1,083.99 crore in Q3 FY 2024-25. Effective cost management played a crucial role.

Shree Cement Ltd.

Shree Cement struggled with a massive 73.20% decline in net profit, dropping from ₹966.38 crore to ₹259.00 crore. High input costs and weaker demand impacted its earnings.

J.K. Cement Ltd.

J.K. Cement’s net profit fell by 28.94%, from ₹414.91 crore to ₹294.84 crore. The decline reflects cost pressures and a slowdown in market demand.

India Cements Ltd.

India Cements posted a huge loss of ₹497.06 crore, compared to a ₹24.03 crore loss in Q3 FY 2023-24, making it the weakest performer. Financial stress and lower sales impacted the company's bottom line significantly.

Conclusion

The cement industry’s Q3 FY 2024-25 performance was a mix of growth and challenges. While ACC and Ambuja Cements reported impressive profit gains, Shree Cement, J.K. Cement, and India Cements struggled with profitability. Rising raw material costs and fluctuating demand played a crucial role in the overall performance. However, with an increase in infrastructure and construction activities, the sector may see recovery in the coming quarters.

In Q3 FY 2024-25, ACC and Ambuja Cements stood out for their exceptional revenue and profit growth, while others like Shree Cement, J.K. Cement, and India Cements faced challenges in maintaining profitability. For those looking to manage their construction budgets effectively, platforms like HouseGyan can offer valuable resources, including calculators to estimate costs related to cement, labor, and materials.

House Gyan all services

Loading...Why Choose House Gyan:

Experience :With years of experience in the construction industry, we have successfully completed numerous projects, earning the trust and satisfaction of our clients.

Quality Assurance :We are dedicated to maintaining the highest standards of quality in every project. Our commitment to excellence is evident in the craftsmanship and attention

Customer-Centric Approach :Your satisfaction is our priority. We prioritize open communication, collaborative decision-making, and a customer-centric approach to ensure your vision is realized seamlessly.

Choose House Gyan, for a construction experience that goes beyond expectations. Contact us today to begin the journey towards your dream home!

The information contained on Housegyan.com is provided for general informational purposes only. While we strive to ensure that the content on our website is accurate and current, we make no warranties or representations of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Housegyan.com will not be liable for any loss or damage including, without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Third party logos and marks are registered trademarks of their respective owners. All rights reserved.